Introduction

Best home insurance Ontario Canada! Owning a home is considered one of lifestyle’s foremost milestones, but it is also considered one of the most important economic commitments you may make. Ensuring that your investment is included is critical, that is where home coverage comes in. In Ontario, Canada, the importance of getting reliable domestic coverage can not be overstated. This guide will walk you through the entirety you need to recognize about locating high-quality domestic insurance in Ontario, from information on the different kinds of coverage to tips for getting an excellent deal.

Understanding Home Insurance in Ontario

Types of Home Insurance

Home insurance in Ontario isn’t one-size-fits-all. There are several types to do not forget, each designed to offer various tiers of safety:

Comprehensive Insurance

This is the maximum inclusive kind of domestic coverage, covering both the building and its contents towards all risks, besides the ones in particular excluded.

Basic Insurance

Also known as named perils coverage, this type simplest covers the risks specifically indexed in the coverage.

No-Fault Insurance

This precise form of insurance permits you to stay out of your personal insurance agency irrespective of who is at fault.

Legal Requirements

While domestic insurance isn’t legally required in Ontario, most mortgage creditors will insist on it before they approve your mortgage. Failing to have domestic insurance can place your loan—and your property—at hazard.

Factors to Consider When Choosing Home Insurance

Location

Where your private home is located plays a big role in determining your coverage charges. Areas vulnerable to herbal failures or excessive crime fees can lead to better charges.

Property Value

The fee of your property and its contents will also have an effect on your premiums. Higher assets values generally imply better charges, as there may be extra to update in the occasion of a loss.

Coverage Options

Different insurers provide distinctive insurance options. It’s vital to evaluate these alternatives to make sure you are getting the protection you need without procuring needless extras.

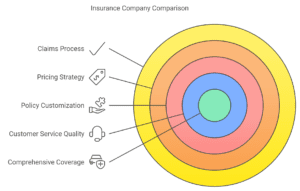

Comparison of Top Home Insurance Providers in Ontario

Provider 1: XYZ Insurance

XYZ Insurance is known for its complete coverage alternatives and high-quality customer service. They offer various accessories which include sewer backup and overland water insurance, making them a flexible desire.

Provider 2: ABC Insurance

ABC Insurance sticks out for its aggressive pricing and person-pleasant on line services. They offer particular coverage customization alternatives, allowing you to tailor your coverage to satisfy your specific wishes.

Provider 3: DEF Insurance

DEF Insurance is renowned for its incredible claims procedure and insurance flexibility. Their customer service crew is to be had 24/7, making sure you may get assist on every occasion you need it.

Real-global Scenarios

Imagine you’ve got skilled water damage due to a burst pipe. XYZ Insurance’s comprehensive policy could cover both the structural harm and the ruined contents. In contrast, a simple policy from ABC Insurance might most effective cowl the structural repairs, leaving you to foot the invoice for damaged furnishings.

Tips for Getting the Best Home Insurance Deal

Improve Home Security

Installing safety systems, smoke detectors, and even deadbolt locks can decrease your rates. Insurance groups often provide reductions for houses which might be less in all likelihood to enjoy a wreck-in or fireplace.

Bundle Policies

Many carriers offer discounts if you package more than one varieties of insurance, which include domestic and car. This can result in huge financial savings.

Shop Around

Don’t accept the primary quote you receive. Compare multiple vendors to ensure you are getting the first-class deal. Online contrast tools could make this method simpler.

Conclusion

Selecting the proper domestic insurance in Ontario involves understanding your alternatives, comparing vendors, and considering ways to decrease your charges. By taking the time to research and examine your needs, you may discover a coverage that gives both peace of thoughts and financial protection. Explore your home coverage alternatives today and reach out to vendors to find the exceptional fit for you.