What Is Home Bakery Insurance?

If you run a home bakery, having the right insurance is crucial. General legal responsibility insurance covers accidents or damage precipitated to others. Product liability coverage enables fees if a person gets ill out of your meals. Equipment insurance protects your gear and machines if they get damaged or stolen.

Without proper insurance, an unmarried declaration might be very steeply-priced. Good coverage can help reduce or even cover these fees, so you’re prepared for any surprises.

Do I need insurance to sell baked goods from home?

Starting a domestic-based baking business is a dream come true for plenty of passionate bakers. The upward thrust in the call for artisanal baked items has made it less complicated than ever to turn your kitchen into a thriving bakery. But as you roll out the dough and whip up frosting, an essential query arises—do you need coverage to promote baked items from home? This manual will discover the criminal landscape of home-based baking, the varieties of insurance mightily need, and why it is important to defend your commercial enterprise.

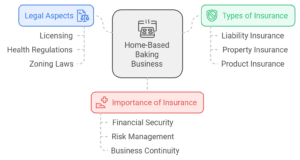

Understanding the Legal Side of Home-Based Bakeries

Starting a domestic-primarily based bakery entails more than just perfecting your recipes. It’s important to recognize the prison requirements that govern such organizations. Depending on where you live, there can be specific regulations you need to follow, which include acquiring lets and licenses. One vital element regularly unnoticed by budding entrepreneurs is the need for coverage.

Local Regulations and Permits

Before you start selling your scrumptious creations, check your local rules. Some jurisdictions require home-based meal businesses to achieve a cottage food license. This permit guarantees that your kitchen meets fitness and protection standards, presenting a safe product to your customers. Failure to comply with those policies can result in fines or maybe closure of your commercial enterprise.

Health and Safety Standards

Meeting health and safety standards isn’t always pretty much avoiding consequences—it is approximately ensuring the well-being of your clients. Regular inspections and adherence to food protection protocols are critical. This includes proper garage, coping with, and labeling of ingredients. Insurance can play a pivotal role right here, imparting coverage for any ability mishaps.

The Need for Insurance

While permits and licenses are essential, insurance affords an additional layer of safety. It shields you from sudden events that might otherwise derail your commercial enterprise. From purchaser accidents to property damage, insurance enables mitigate risks, ensuring your dream stays intact.

Types of Insurance for Home-Based Baking Businesses

When it comes to coverage for your home-based bakery, numerous sorts can offer protection. Understanding those options will assist you pick out the great insurance you desire.

General Liability Insurance

General liability insurance is a have-to-have for any enterprise, together with home-primarily based bakeries. This form of coverage covers claims associated with 1/3-party physical damage, property damage, and private injury. For instance, if a customer slips and falls at the same time as picking up an order from your house, preferred legal responsibility insurance could cover the clinical fees and felony costs.

Property Insurance

Property insurance protects your baking equipment and components from harm or robbery. Imagine waking as much as find your oven malfunctioned overnight, ruining your stock of baked goods. Property insurance might cover the cost of changing your system and lost stock, allowing you to get back to commercial enterprise speedy.

Product Liability Insurance

Product liability coverage is specifically critical for food organizations. This insurance protects you if your baked goods purpose damage to a client. Whether it is a hypersensitive reaction or meal poisoning, product liability coverage covers medical fees and legal costs, safeguarding your reputation and budget.

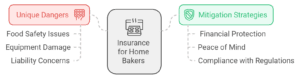

The Importance of Insurance in Home Baking

Insurance is not just a criminal requirement—it’s a safety net for your commercial enterprise. Let’s explore the unique dangers domestic bakers face and the way insurance mitigates them.

Customer Injury

Accidents show up, even inside the safest environments. A patron could ride on the doorstep or burn themselves on hot packaging. Without insurance, you could be accountable for clinical charges and prison costs. General legal responsibility insurance covers these expenses, making sure one twist of fate doesn’t spoil your business.

Property Damage

Your domestic is each your residing space and your enterprise premises. If a fireplace, flood, or robbery damages your baking system or ingredients, assets coverage covers the fee of repairs and replacements. This lets you preserve operating your enterprise without great financial setbacks.

Product Spoilage

Quality control is crucial in the food industry. If your products smash, it could lead to purchaser proceedings or health problems. Product legal responsibility coverage covers claims associated with spoiled goods, defends your enterprise from lawsuits, and makes sure customers accept it as true.

How to Get Insured for Your Home-Based Bakery

Obtaining insurance may appear daunting, however, it’s a truthful system if you recognize what to look for. Here are practical steps to help you get started.

Finding a Reliable Insurance Provider

Start through gaining knowledge of coverage companies focusing on small groups or domestic-based total organizations. Look for organizations with correct opinions and a track document of dependable service. Don’t hesitate to invite tips from different domestic bakers or nearby commercial enterprise associations.

Understanding Policy Options

Once you have diagnosed capability carriers, examine their policy alternatives. Make sure to read the pleasant print and recognize what every coverage covers. Some vendors offer bundled applications that encompass well-known legal responsibility, assets, and product legal responsibility coverage at a reduced charge.

Getting Quotes and Making a Decision

Request costs from multiple carriers to compare costs and coverage. Remember, the most inexpensive option isn’t always always the first-rate. Consider the insurance limits, deductibles, and exclusions before making a decision. Once you’ve selected a coverage, work together with your issuer to complete the important paperwork and price.

Real-Life Case Studies

Learning from others’ stories can provide precious insights. Here are a few actual-life examples of domestic bakers who benefited from having insurance or faced challenges due to loss of insurance.

The Cautious Baker

Gigi, a domestic baker from California, decided to get standard legal responsibility and product legal responsibility insurance before starting her commercial enterprise. One day, a consumer slipped on her driveway whilst choosing up an order. Thanks to her coverage, Sarah didn’t need to fear about the scientific bills or prison costs.

The Uninsured Mishap

Alex, another home baker, concept insurance changed into a useless expense. Unfortunately, a batch of his cookies brought about an allergy in a patron. Without product liability insurance, John confronted a lawsuit that placed him out of enterprise.

The Property Damage Scenario

Emily, an experienced baker, invested in belongings coverage for her domestic-based bakery. When a kitchen fireplace destroyed her device and inventory, her coverage included the substitute charges. She becomes able to resume her enterprise quickly without enormous monetary loss.

Conclusion

Starting a domestic-based baking commercial enterprise is an interesting mission, but it is vital to shield your dream with the right coverage. From purchaser injuries to belongings damage and product spoilage, the dangers are real. By knowing the criminal requirements, exploring the kinds of coverage to be had, and taking sensible steps to get insured, you could safeguard your commercial enterprise and awareness of what you do with high-quality—baking scrumptious treats.

If you’re geared up to take the subsequent step in protecting your property-primarily based bakery, bear in mind accomplishing out to a coverage provider nowadays. Ensuring your commercial enterprise is included will provide you with peace of mind and will let you be cognizant of developing your venture. Happy baking!