Introduction

In an age of Toggle Auto Insurance where customization and versatility have grown to be the cornerstones of modern-day residing, conventional constant vehicle coverage guidelines may experience old. Enter toggle auto insurance—a dynamic, actual-time coverage version that puts manipulated returns inside the fingers of the driving force. This innovative method allows you to modify your coverage according to your desires, making sure you handiest pay for what you operate. But what exactly is toggle vehicle coverage, and why is it gaining traction? Let’s explore.

Understanding Toggle Auto Insurance

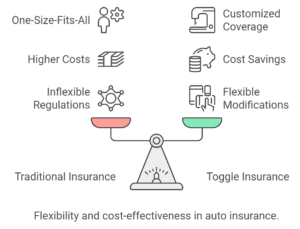

Toggle vehicle insurance represents a full-size departure from traditional auto coverage fashions. Unlike general rules that offer fixed coverage for a fixed duration, toggle auto insurance allows customers to regulate their coverage in real time. This flexibility is enabled through advanced technology and digital platforms, supplying an unbroken consumer enjoy.

With toggle auto insurance, drivers can alter their insurance primarily based on their instantaneous use needs. Whether you’re planning a move-united States Avenue trip or reducing insurance in the course of a duration of less use, toggle coverage adapts to your lifestyle.

Benefits of Toggle Auto Insurance

One of the number one advantages of toggle auto insurance is its remarkable flexibility. Traditional automobile insurance regulations often include inflexible phrases and situations, that might not be healthy for anyone’s needs. In evaluation, toggle coverage gives a greater adaptable approach, making an allowance for temporary modifications.

Cost-effectiveness is every other great advantage. Because you can tailor your coverage in your cutting-edge instances, you keep away from paying for unnecessary functions. This customization can cause large financial savings, especially for infrequent drivers or folks who enjoy seasonal modifications in their driving habits.

Additionally, toggle auto insurance caters to diverse driving behaviors and life. From metropolis dwellers who do not often use their vehicles to avenue warriors constantly on the circulate, this insurance version adjusts to fit the particular wishes of every motive force.

Types of Coverage and Customization

Toggle auto insurance offers a variety of coverage alternatives, starting from primary legal responsibility to complete plans. Each coverage can be custom-designed to include capabilities like collision, robbery, and private injury safety, depending on your requirements.

Customization examples abound. Suppose you are planning a summertime avenue journey; you may briefly enhance your coverage to consist of roadside assistance and increased liability. Alternatively, if you’re storing your automobile for iciness, you may lessen your coverage to the bare minimum, saving on premiums.

The ability to toggle specific aspects of your coverage ensures that you’re in no way over-insured or underneath-insured, providing the right balance of safety and cost performance.

The Future of Toggle Auto Insurance

The upward push of toggle auto insurance signals a broader fashion closer to personalization and user manipulation in the insurance zone. As the generation keeps improving, we can count on even greater revolutionary answers that empower customers to manipulate their insurance correctly.

Emerging developments encompass the combination of telematics and synthetic intelligence to offer actual-time information on driving behavior. These records can similarly refine and personalize coverage guidelines, making sure that drivers acquire the maximum accurate and honest coverage feasible.

The effect of toggle coverage in the industry is profound. It demands situations traditional models and encourages different providers to undertake comparable processes, ultimately benefiting purchasers through accelerated competition and better provider services.

How to Choose the Right Toggle Insurance

Selecting the right toggle insurance company requires cautious consideration of numerous elements. Transparency is crucial—make certain that the company genuinely explains its terms and situations, in addition to any charges associated with adjusting your insurance.

Customer carrier is every other vital factor. Look for vendors with robust reputations for responsiveness and aid, as this will appreciably beautify your enjoyment.

Finally, evaluate the virtual enjoyment. A user-pleasant app or platform is vital for handling your policy successfully. Check for features like clean navigation, actual-time updates, and secure price alternatives.

Case Studies and Success Stories

Consider the case of Sarah, a freelance image dressmaker who drives on occasion. With toggle vehicle insurance, she was able to lessen her coverage at some stage in months while she slightly used her car, saving loads of greenbacks annually. When she decided to take a month-long street experience, she effortlessly accelerated her insurance to consist of additional protections, giving her peace of thought at some stage in her travels.

Another example is the Martinez family, who have two vehicles but in general use one. By toggling their coverage, they optimized their insurance prices, making sure they were only paying for what they wished. This flexibility allowed them to allocate extra funds in the direction of their family vacations and other priorities.

These fulfillment memories highlight the realistic blessings of toggle auto insurance, showcasing how customization can cause giant financial savings and comfort.

Conclusion

Toggle auto insurance is more than only a fashion—it is a transformative technique that meets the evolving wishes of contemporary drivers. Offering flexibility, price financial savings, and tailor-made insurance, it stands to revolutionize the coverage enterprise.

If you’re bored with inflexible rules and want extra management over your car insurance, it’s time to explore toggle alternatives. Whether you force it day-by-day or now and then, there may be a toggle plan that can cater to your way of life and budget.

Consider evaluating your present-day coverage scenario and discovering how to toggle auto insurance can decorate your coverage enjoy. For greater information and personalized advice, explore associated sources or talk with a coverage expert to find the pleasant solution in your wishes.