Understanding Home Insurance After Builders Risk

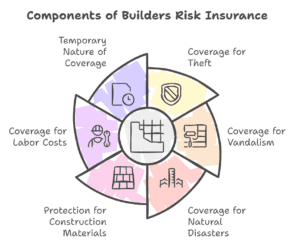

Home Insurance After Builders Risk is building or renovating a home is a huge assignment with its dangers and challenges. Builders hazard coverage is a specialized property insurance designed to cover homes under production. Whether you’re a house owner, contractor, or developer, this insurance affords insurance against potential losses which include theft, vandalism, or damage from natural screw-ups for the duration of the development phase.

Builders risk coverage is important because it guarantees your funding is blanketed from unexpected activities. It covers the construction substances, furniture, or even the labor expenses required to rebuild or repair broken belongings. However, it is important to apprehend that this sort of coverage is temporary and tailor-made, particularly for the construction duration.

Introduction to Coverage Scope

Starting a domestic construction or protection assignment is an exciting time for homeowners. However, it also comes with a set of risks that need to be managed correctly. This is in which expertise in the variations among builders’ risk insurance and homeowners insurance will become crucial. Builders risk insurance is particularly designed to cover production-related risks, at the same time as owner coverage focuses on protecting the structure and contents of a finished domestic. In this blog, we can discover the nuances of both types of insurance and explain why builders’ chance coverage is crucial during the construction section.

Broader Scope of Builders Risk Insurance

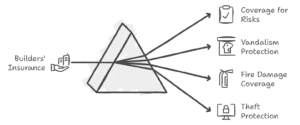

Builders’ danger coverage gives complete coverage for numerous production-associated risks. This includes safety for building materials, devices, and unfinished systems. Imagine a situation wherein a precession website is vandalized, resulting in enormous harm to the materials. Builders’ danger insurance could cover the costs related to thisBuilders’aking sure that the undertaking can hold without economic setbacks.

Additionally, developers’ danger insurance covers perils including robbery and the developer’s herbal failures that may arise at some point in production. For instance, if a fire breaks out and destroys a partly built shape, the coverage could cover the charges of rebuilding, minimizing the monetary burden on the homeowner broader scope of insurance makes builders” threat coverage essential for any creation mission.

Limited Scope of Homeowners Insurance

In evaluation, homeowners coverage is designed to shield finished homes and normal residing risks. It covers the shape of the house, private belongings, and legal responsibility. However, it does now not expand to homes underneath construction or the unique dangers associated with building projects. For instance, if creation materials are stolen from a job web page, owner coverage cannot cover the loss, leaving the property owner to undergo the costs.

Homeowners insurance is more suitable for defense against dangers inclusive of fireplaces, theft, and liability as the home is constructed and occupied. It affords peace of thought for ordinary residents however falls short in terms of overlaying production-as resident incidents. Therefore, relying entirely on house owners’ coverage at some point in the development section can fill huge gaps in insurance.

Use Case Comparisons

To illustrate the variations, let’s recall a state of affairs in which a hurricane damages an unfinished domestic. Builders’ hazard insurance would cover the charges of repairing the structure, changing broken substances, and continuing the challenge. On the other hand, the house owner’s insurance would not cover these fees, as the home is not but completed. This highlights the significance of getting builders” danger insurance in location to safeguard the investment for the duration of construction.

Another instance is the robbery of production equipment from the task website online. Builders” chance coverage might cover the replacement expenses, even as homeowners insurance would no longer provide any coverage for this type of loss. These examples emphasize the want for specialized coverage presented with the aid of developers’ hazard coverage to protect in opposition to production-specific risks.

Definition of Coverage Limits

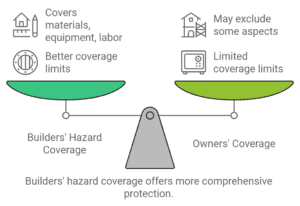

Coverage limits in insurance confer with the maximum quantity the insurer pays for a covered loss. Builders” hazard coverage commonly offers better coverage limits compared to owners” coverage, making it more suitable for excessive-fee creation projects. These limits are tailor-made to cover the treasured substances, equipment, and labor charges involved in constructing or renovating a home.

Higher Limits in Builders Risk Insurance

Custom houses and massive-scale renovations often involve huge investments. Builders threat coverage offers higher insurance limits to ensure that these investments are safely covered. For example, if a custom-constructed home is worth $1 million, the coverage policy would mirror this cost, presenting comprehensive insurance for the whole venture.

In addition to the structure, developers’ chance coverage covers construction substances, equipment, and hard work prices. This way if there’s harm or robbery, the coverage will cover the replacement or restore prices, permitting the venture to continue without financial setbacks. This better degree of coverage guarantees that homeowners are not left liable to full-size losses all through the development section.

Homeowners Insurance Coverage Limits

Homeowners insurance, however, commonly covers the price of the existing home, non-public property, and liability. The coverage limits are primarily based on the appraised cost of the completed home and do not account for the extra charges associated with ongoing construction projects. This restricted insurance may be inadequate for excessive cost creation or upkeep projects.

For instance, if a homeowner is constructing an addition to their home, the development costs can also exceed the coverage limits of their homeowner’s coverage. Any damages or losses incurred for the duration of the construction phase would now not be fully protected, leaving the homeowner to undergo the financial burden. This is why builders” chance insurance is essential for ensuring that the complete project is satisfactorily blanketed.

Comparison Examples

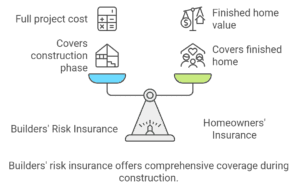

Consider a state of affairs where a property owner is building a custom domestic worth $1.Five million. Builders” danger coverage could offer coverage that reflects the full cost of the challenge, which includes construction substances, labor fees, and equipment. In contrast, owners’ coverage could only cover the finished home, which may be worth $800,000, leaving a sizeable insurance gap for the continued production.

Another example is a protection undertaking wherein the house owner is upgrading their kitchen. If a hearth breaks out in the course of the upkeep, developers’ danger insurance would cover the fees of repairing the kitchen and replacing any broken substances. Homeowners coverage, however, could now not cover the maintenance fees, as the venture isn’t always yet finished. These examples spotlight the significance of getting builders hazard coverage to make sure comprehensive coverage throughout construction.

Understanding Policy Terms

Favorable policy phrases talk about the ability, coverage length, and customization alternatives available in coverage. Builders’ danger insurance gives extra favorable policy phrases as compared to owners’ insurance, making it better appropriate for production tasks. These terms are designed to accommodate the unique wishes and timelines of constructing or renovating a home.

Flexibility in Builders Risk Insurance

Builders’ threat coverage regulations are tailor-made to particular tasks, making an allowance for customizable begin and quit dates. This flexibility guarantees that the insurance aligns with the development schedule, supplying safety at some point in the whole assignment. Whether the assignment takes six months or two years to complete, the coverage may be adjusted for this reason.

In addition to a flexible insurance period, developers’ threat coverage can cover a wide variety of substances, contractors, and production levels. This complete coverage ensures that each factor of the mission is included, from the preliminary foundation to the very last touches. Homeowners may have peace of mind understanding that their funding is safeguarded at each stage of creation.

Fixed Nature of Homeowners Insurance Terms

Homeowner coverage, on the other hand, comes with standardized insurance phrases that do not account for creation-phase issues. The coverage is designed to cover completed homes and traditional living dangers, with much less adaptability for predominant maintenance or production tasks. This constant nature of the phrases can leave homeowners with inadequate insurance in the course of the construction manner.

For example, if a house owner is a task a year-long renovation project, their house owner’s coverage would no longer provide insurance for creation-associated dangers at some point in the duration of the undertaking. This lack of flexibility highlights the restrictions of relying entirely on homeowners insurance at some stage in construction.

Policy Term Comparisons

Let’s recall a case have a look at in which a house owner is constructing a custom domestic with an anticipated final touch time of 18 months. Builders’ danger coverage may be tailored to cover the entire construction length, providing safety from beginning to completion. This includes insurance for substances, hard work charges, and any unexpected incidents that may occur for the duration of creation.

In comparison, house owners’ coverage would no longer offer an equal level of insurance for an ongoing creation project. The constant terms of the coverage would only apply to the finished home, leaving sizeable gaps in insurance at some point in the development segment. This evaluation underscores the importance of choosing developers’ danger coverage for comprehensive safety throughout building or maintenance tasks.

Preventing Claims Through Proper Coverage

Builders threat insurance performs a critical position in minimizing the need to make claims on homeowners coverage at some point of creation. Providing coverage for creation-unique dangers, it saves you from placing undue stress on the house owner’s coverage. This no longer best protects the funding but additionally preserves the property owner’s insurance for later use.

Builders Risk Insurance for Construction-Specific Claims

Construction accidents, robbery of materials, and herbal failures throughout construction are commonplace risks that developers’ risk coverage covers. For example, if a production worker is injured on the website, the coverage would cover the medical prices and capability legal responsibility claims. Similarly, if a typhoon damages the partly built structure, the coverage would cover the restoration costs, ensuring the assignment can be kept without financial setbacks.

This specialized coverage for construction-particular claims ensures that homeowners aren’t left susceptible to widespread losses in the course of the construction procedure. It presents peace of mind understanding that any incidents that occur at some stage in construction are adequately blanketed.

How It Protects the Homeowner’s Policy

By the use of developers’ hazard insurance all through creation, homeowners can keep away from making huge claims on their house owners’ coverage for problems that arise during the building phase. This preserves the homeowner’s policy for later use, ensuring that it remains intact for normal residing risks as soon as the home is completed. It also prevents the homeowner’s coverage rates from growing due to production-associated claims.

For instance, if a fire breaks out at some point in construction, the developer’s hazard coverage would cover the restoration costs, removing the need to claim on the homeowner’s policy. This protects the homeowner’s insurance from potential rate hikes and ensures that it remains available for destiny use.

Long-Term Financial Benefit

Having developer’s threat coverage in the vicinity throughout creation offers lengthy-term economic blessings. It allows the preservation a easy records on the property owner’s coverage, which can result in decreased premiums over time. Additionally, it ensures that any construction-related incidents are included, preventing big out-of-pocket expenses for the homeowner.

For example, if a homeowner is constructing a new domestic and a robbery occurs on-site, the builder’s risk insurance might cover the replacement charges. This prevents the property owner from having to endure the financial burden, allowing them to allocate their resources in the direction of finishing the mission. Over time, this may cause considerable financial savings and monetary stability.

When Does Builders Risk Coverage End?

Understanding while the developer’s chance coverage ends is critical to maintaining continuous safety for your private home. Typically, insurance ends when the construction assignment reaches of entirety. This finishing touch may be decided by using numerous factors, which include the issuance of a certificate of occupancy, the end of the development contract, or the property’s first use.

It’s essential to talk together with your coverage issuer to recognize the particular terms of your builder’s threat policy. This verbal exchange ensures that you can seamlessly transition to a home coverage policy, averting any gaps in insurance that would leave your own home vulnerable.

Conclusion

In the end, builders’ threat insurance is a critical element of any construction or upkeep challenge. It provides complete coverage for creation-related dangers, ensuring that house owners are protected for the duration of the building technique. By supplying higher insurance limits, bendy coverage terms, and specialized insurance for production-unique claims, builders’ danger insurance minimizes the need to make claims on owners’ coverage and gives long-term financial advantages.

For homeowners embarking on a construction or maintenance undertaking, investing in developers’ hazard insurance is a prudent choice. It safeguards the investment, prevents financial setbacks, and ensures that the mission can continue smoothly. If you are geared up to explore developers’ hazard insurance options, contact a reputable insurance issuer nowadays to examine more and get commenced.